The main findings:

• SCSI members expect residential property prices to increase by an average of 2% in 2023

• While economic uncertainty, inflation and interest rate hikes have dampened down the market, affordability and viability remain key issues

• SCSI agents believe 40% of sales instructions in Q4 were landlords selling their investment property

• 8 out of 10 agents believe buy-to-let second hand rental units being sold now will not be replaced in the rental market in the next two years

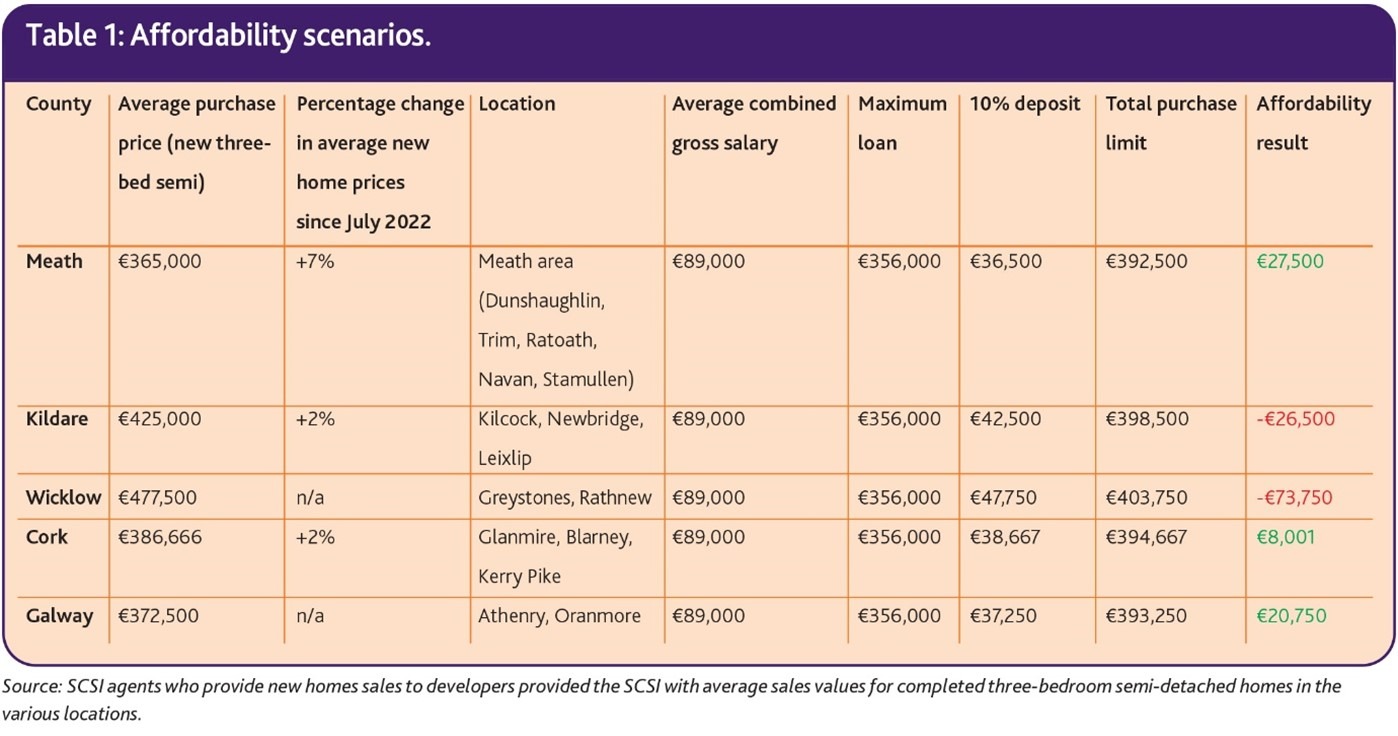

• Case studies show new homes remain unaffordable for first time buyers in several counties – by up to €74,000 in Wicklow and by €27,000 in Kildare

• New homes are affordable to those on average incomes in Meath, Cork and Galway

• SCSI says housing output will have to increase by 8% per annum if Housing for All targets are to be hit by 2030

Friday 13th January 2023: While residential property prices recorded double digit growth last year the average rate of increase nationally is expected to stabilise to 2% this year according to a new survey of estate agents by the Society of Chartered Surveyors Ireland.

Although sales activity was reported to be brisk up to the summertime, the survey found there was a marked change in the second half of the year with SCSI members attributing the downward shift in activity and sentiment to economic uncertainty and rising interest rates.

Agents believe these two factors look set to dominate the market this year with prices expected to rise by just 1% in the first quarter and by another 1% over the course of 2023.

Case studies compiled as part of the survey – see below – show that new 3 bed semi-detached homes remain out of reach by tens of thousands of euro for first time buyers on average salaries in some parts of the country, specifically Wicklow and Kildare.

John O’Sullivan, Chair of the SCSI’s Practice and Policy Committee said that schemes like ‘Help to Buy’ and ‘First Home Shared Equity’ are vital to the ongoing delivery of housing and in ensuring the viability of new home construction.

“Residential values have increased exponentially in the past number of years with year-on-year house price inflation running at 10% nationally. Increases of that magnitude are simply not sustainable and a return to a more stable environment is welcome in terms of affordability.”

“However, the price inflation we have seen was also a response to higher construction costs and helped ensure some housing projects remained viable. If values plateau or fall during a period of high construction inflation, many projects may stall or not commence and that is a real concern given the current housing crisis” he said.

The SCSI’s Annual Residential Review and Outlook report – now in its 40th year – also found that increasing levels of buy-to-let properties are continuing to come on the market for sale. On average 40% of residential sale instructions to agents in Q4 were landlords selling their investment property.

Mr O’Sullivan said the marked drop off in viewings activity in Q4 and the large proportion of rental properties coming on the market illustrate some of the complex challenges facing the property market at this time.

“The report shows a significant decline in viewings and sales in Q4 2022 when compared with Q4 2021. While forty-nine per-cent of agents reported an increase in sales and viewing activity in Q4 2021 – largely due to pent-up demand in the wake of covid – this fell to just 15% in Q4 2022.”

“Well-presented houses in good condition that are priced correctly are performing well when placed on the market for sale. Agents say homebuyers are showing a growing preference for completed ‘A Rated’ homes rather than properties that require renovations / modernisation or those with poorer Building Energy Rating (BER) while high speed broadband is also a major plus.”

“Although the trend of second-hand buy-to-let properties coming on the market was in evidence throughout 2022, it appears to have ramped up in the last quarter of the year. While this may have helped to increase the number of properties available for sale – 66% of agents reported low stock levels this year as opposed to 85% last year – the lack of supply remains the dominant issue in the market.

“Of course, the trend of private landlords exiting the market has serious implications for the supply of rental properties. SCSI agents are reporting that the supply of available units to rent is at one of the lowest levels ever experienced and they don’t believe the situation is set to improve in the short term.”

“Almost 8 out of ten agents (78%) surveyed are of the view that individual buy-to-let second-hand rental units being sold at present will not be replaced in the rental market in the next two years” Mr O’Sullivan said.

The survey found the three primary reasons for occupied residential units coming back onto the market for sale include

– The complex and restrictive nature of rent regulations

– Landlords finding compliance with rented housing standards too onerous

– Net rental returns too low

The survey also found that 59% of agents surveyed reported an increase of tenants overholding rented property in the past two years. This is where tenants remain in a property after a valid notice of termination has expired and is indicative of the difficulties renters face when trying to find an alternative rental property.

SCSI New Home Affordability Tracker

Case studies compiled for this year’s report, show that while new 3 bed semi-detached homes remain affordable to first time buyer (FTB) couples on average incomes in Meath, Cork and Galway, they remain out of range by tens of thousands of euro for couples in Wicklow and Kildare.

The studies, which are for illustrative purposes, show Kildare and Wicklow are unaffordable for FTBs based on average house price by as much as €27,000 and €74,000 respectively.

Meath, Cork and Galway remain affordable to the average FTB couple with available purchasing power exceeding new homes prices by as much as €28,000, €8,000 and €21,000 respectively.

John O’Sullivan said that while it was important to note that Wicklow has the second highest house prices in the country after Dublin, the case study provides a good example of the relationship between demand and supply. “New house completions in Kildare are around 7,200 but in Wicklow that figure is almost half that, at 3,800. So when you have low supply and high demand, prices are going to rise accordingly.”

Table 1. Affordability scenarios based on couples with average salaries in five counties looking to buy a new 3-bed semi-detached home. The case studies take the average salary of €89,000 for a couple working in the public sector, e.g. combined wages of two gardaí/nurses after 10 years’ service or two executive officers after c. nine years of service. Their total LTI maximum loan limit is €356,000 (4 times gross salary). As first-time buyers, they require a 10% deposit.

Housing for All

Although new housing completions in 2022 are expected to be at their highest levels in approximately a decade – circa 25,000 – there is concern among SCSI agents that commencements and planning permission numbers are declining and that this will have a direct impact on the number of completions this year and possibly into 2024.

Some SCSI agents report in the survey that the cost of construction is a particular concern in relation to the supply of new homes with inflation and labour shortages contributing to higher costs.

The SCSI estimates that based on current new housing completion projections there will need to be an increase of almost 8% of new home output each year to 2030 to meet overall ‘Housing for All’ targets. According to this measure Ireland would need to be building 27,000 new homes this year, rising to 39,000 in five years’ time and over 45,000 by 2030.

The National Planning Framework review is due in Q1 2023 and any revision of the Housing Needs Demand Assessment may further impact these numbers to suggest more supply is needed to meet the demands of our growing population.

The SCSI’s Annual Residential Property Review and Outlook Report 2023 is available here.

Ends.

For further information

Contact Kieran Garry

GPR Communications

Note to Editor

About the Survey

The SCSI Annual Residential Property Review & Outlook 2023 is a sentiment report, which has captured over 300 responses from SCSI agents across the country, and over two SCSI/Central Bank of Ireland property professional surveys during 2022.

• Central Bank/SCSI Quarterly Residential Property Survey (May 2022)

• SCSI National Property Outlook Survey 2022 (December 2022)

While the principal focus of these surveys is on participants’ house price expectations, the survey also canvasses opinions on the factors underlying these views and on their assessment regarding the level of transactional activity in the market.