House rebuilding costs have increased by an average of 12% nationally over the last 12 months

SCSI welcomes moderation in rate of increase – in the previous 12 months the figure was 21%

New report shows consistent increase in average rebuild costs across the country but notable differences between house types

SCSI says the increase in rebuild costs continues to be driven by shortage of labour and high demand for builders

Chartered Surveyors urge consumers to check their homes are adequately insured using the SCSI’s updated House Rebuild Calculator

Friday 20th October 2023. The latest House Rebuilding Guide published by the Society of Chartered Surveyors Ireland (SCSI) shows that national average re-build costs, which include demolition and site clearance, have increased by an average of 12% over the past 12 months. This is down significantly on the 21% increase recorded in the previous 12 months, a moderation in the rate of increase which was welcomed by the SCSI.

This year’s SCSI House Rebuilding Guide, which is used by homeowners to calculate the rebuilding costs of their home for house insurance purposes, shows a consistent increase in rebuild costs across the country with the majority of regions recording an average increase of 12% to 13%. Last year the increases ranged from a low of 14% in Dublin to a high of 26% in the North-West.

However, the guide finds there can be a notable difference in the increase depending on house type even within the same region with increases ranging from a low of 8% for a three-bedroom terraced house in Limerick to 14% for a semi-detached or detached house. Chartered Quantity Surveyor Kevin Brady said the continuing increase in rebuild costs is a direct result of the shortage of construction labour across the sector combined with high levels of demand for builders.

“Overall, the construction market is extremely busy, and this means it can be difficult to source labour or subcontractors for any type of build, particularly electrical, plumbing and heating. Material prices have started to stabilize for certain materials, however concrete products

are still experiencing price increases as are insulation products, windows, and plumbing products and these are some of the key material cost drivers. Rebuilding a property is not the same as building new houses on a green field site. It requires specialist skills relating to demolition and supporting neighbouring properties. Rebuild projects can also present access challenges. As a result, it is almost a niche market and there can be difficulty sourcing contractors to take on rebuild projects. This will naturally be reflected in tender prices for such projects.”

Fig 1 SCSI Rebuild Guide 2023 Table of average rebuilding costs, per square metre for different house types in different regions. In addition to house rebuilding costs, costs for garages range from €21,500 for a single attached garage to €38,500 for a double attached garage, on average. Note – The rebuilding rates quoted here are for estate type homes only and should not be used for other house styles such as one-off homes in the countryside or period properties. The figures are a minimum base cost guide for house insurance purposes.

Importance of being properly insured

While price increases may have moderated, Dublin, not surprisingly as Fig 1 one shows the capital still has the highest rebuild costs, while the North-West is among the lowest.*

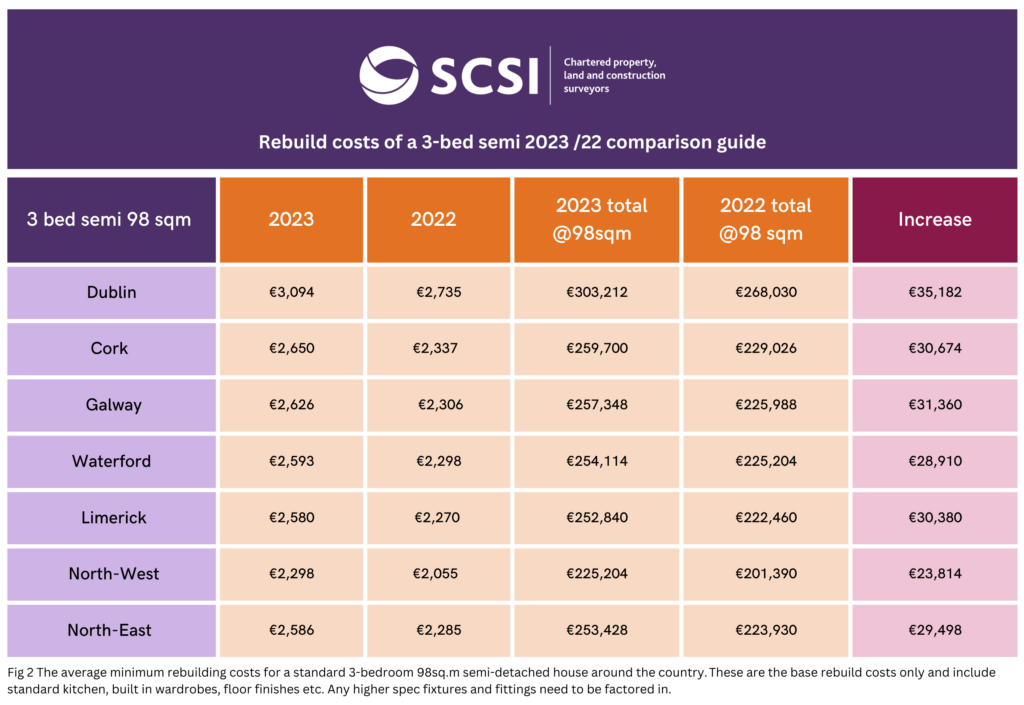

According to these figures the minimum base cost of rebuilding a 3-bed semi, the most common house type in the county is €303,212 in Dublin (98sqm x €3,094) while the minimum base cost of rebuilding a similar house in the North-West, is €225,204 (98sqm x €2,298) – a difference of just over €78,000 (See Fig 2). The SCSI is urging homeowners to take the time to ascertain the correct reinstatement cost based on house type and location.

“Homeowners need to ensure their house is adequately insured so that in the event of a total or partial loss situation ie a fire, they are covered under their insurance policy when reinstating or rebuilding. For example, rebuild costs for a 3-bed-semi – see Fig 2- the most common house type in the country have increased from circa €24,000 to €35,000 depending on where you live over the past 12 months. While these increases are considerable it does not necessarily mean the premium will increase on a pro-rata basis and homeowners are advised to shop around when seeking insurance cover for their homes. It’s really important for homeowners to put aside ten minutes to use the SCSI Home Rebuild Calculator, which is free – to get an accurate reinstatement figure and ensure their home insurance is up to date. If it’s not they need to contact their home insurer” Mr Brady said.

The SCSI points out that the rebuild figures are based on estate type houses and people with one-off homes or period properties are advised to contact their local chartered surveyor. A list of chartered quantity surveyors who carry out these assessments is also available on the SCSI website.

Fig 2 The average minimum rebuilding costs for a standard 3-bedroom 98sq.m semi-detached house around the country. These are the base rebuild costs only and include standard kitchen, built in wardrobes, floor finishes etc. Any higher spec fixtures and fittings need to be factored in.

Dangers of under insurance

The President of the SCSI Enda McGuane said two issues which come up regularly regarding insurance are consumers mixing up valuations with rebuilding costs and homeowners not fully appreciating the dangers of under insurance.

“A market valuation is the expected amount another person would pay for your property, ie the sale price, if it was placed on the open market. The rebuilding cost is the cost or price of building or replacing the dwelling. The SCSI says these figures are very different so it’s important that the SCSI calculator is not used for valuation purposes so that consumers are not over or under insured.”

The other key issue homeowners often don’t realise is that if they are not adequately insured, they may be penalised under their policy by having to pay a certain proportion of the reinstatement costs out of their own pocket.

“Where, the insured sum is only 80% of the total reinstatement cost, you will only receive 80% of the agreed cost of reinstatement, whether the claim is made for partial replacement or total loss. For example, in the case of a house insured for €280,000, where the actual total reinstatement cost is €350,000, the insured party will receive only €280,000 to reinstate the house in the event of the total loss. In that situation the insured party will be obliged to provide the balance of €70,000. Similarly, if there is a partial loss, which costs €100,000 to repair, the insured party will only receive €80,000 and will have to provide the balance of €20,000. This is something many homeowners may not be aware of. It’s also important that homeowners reassess their cover to take account of any changes such as home office extensions or garden offices. These have become very popular in recent years with more people now working from home, but they need to be included in the house insurance.”

A House Rebuilding Calculator and the 2023 Guide to House Rebuilding Costs is available free at scsi.ie/calculator

*It’s important to note, for people whose homes have been affected by Mica or Pyrite, that there are important differences between the SCSI’s Report on Construction Costs for the Defective Concrete Block Grant Scheme – which provided independent average rebuilding costs under which people whose homes have been affected by these issues can apply for grants to restore their properties – and the SCSI Guide to Rebuilding for Insurance Purposes. The cost calculations for both are based on very different criteria, hence the differences between them.