The Key Findings:

- Estate agents expect national property prices to increase by an average of 4% this year

- 7 out of 10 agents are reporting low levels of stock

- 83% believe prices are either rising and will level off soon or have already peaked

- In the report, the affordability analysis looks at a couple earning €112K and the challenges they face

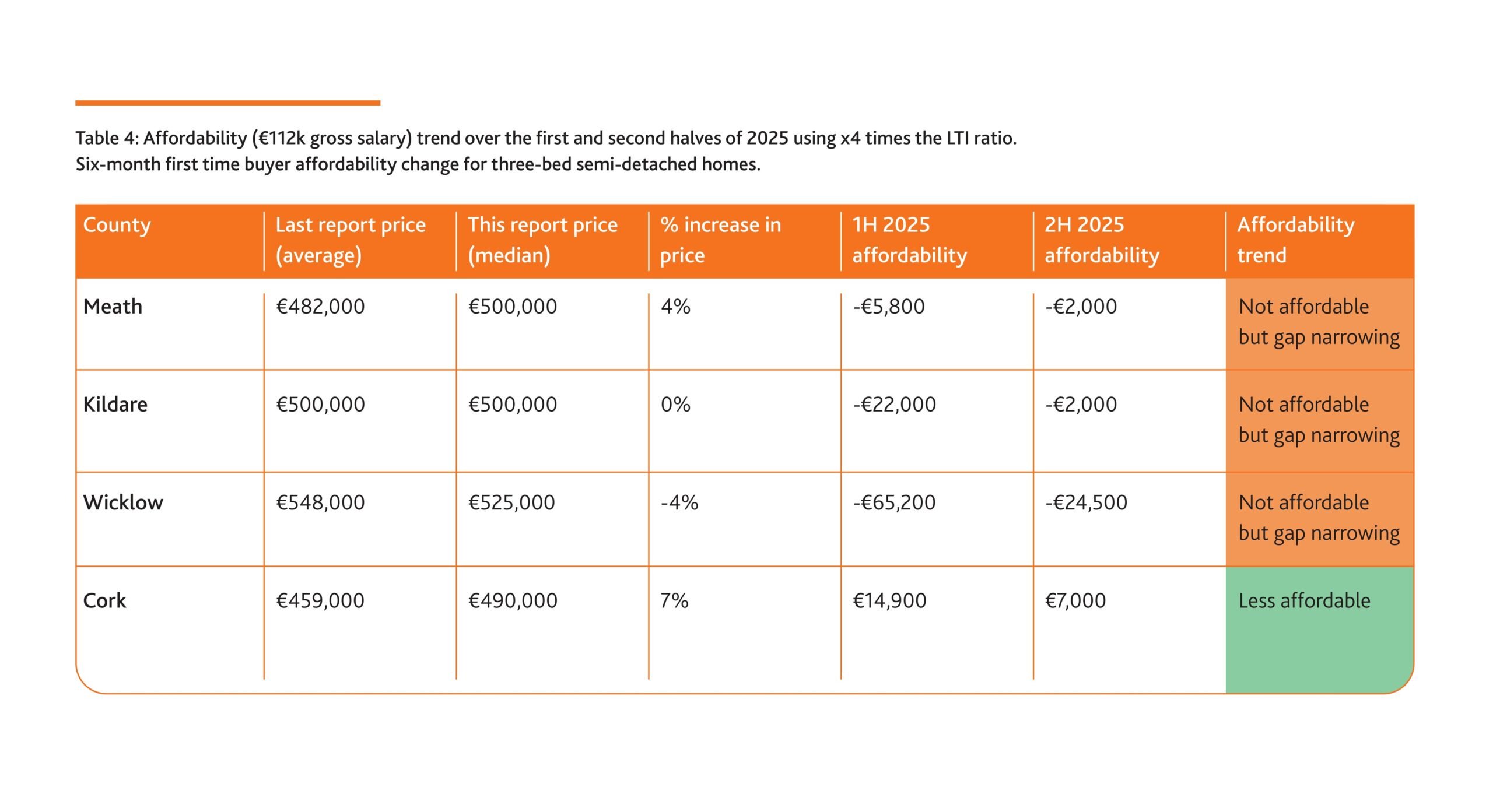

- The scenarios show the couple could afford a 3-bed semi in Cork, while the affordability gap in Kildare and Meath is €2,000

- However, in Wicklow, they would face a shortfall of €24K

- In the rental sector, 86% of agents expect more landlords to leave the market due to the extension of Rent Pressure Zones nationwide.

- The SCSI is calling on the Government to pause new rental reforms

Thursday 5th February 2026: Estate agents from the Society of Chartered Surveyors Ireland (SCSI) expect national property prices to increase by an average of 4% this year.

This is down slightly on the 5% increase which SCSI agents forecast for the market last summer and the 6% forecast this time last year. Recently, the CSO reported that the annual rate of property price inflation is 6.6%.

The SCSI’s Annual Residential Review and Outlook report – now in its 43rd year – found that 84% of agents now believe current property prices are either ‘expensive’ or ‘very expensive’.

However, a similar number of the almost 200 agents who took part in the survey, believe prices are either rising and will level off soon or are at their highest level and should start to decline.

Fifty-eight per-cent of agents believe they are rising but will plateau soon, while an additional 23% believe prices have peaked – a total of 83%.

Gerard O’Toole, President of the SCSI said that while house prices look set to continue to rise, most agents expect the rate of increase to moderate.

“Constrained supply is driving sustained house price growth and mounting affordability pressures for home buyers and renters. Those trends look set to continue through 2026 and beyond.

“Seventy-two per-cent of agents reported low stock levels, and while this is down slightly on last year, the lack of supply is clearly one of the main factors influencing expectations around house price movements. Indeed, when asked what they thought was the primary driver of price increases, almost six out of ten respondents (58%) said it was the level of homes being built.”

“Clearly low levels of new housing stock continue to challenge efforts to meet both pent-up and ongoing accommodation demands. In that context, the confirmation by the CSO recently that over 36,000 new homes were completed in 2025, an increase of over 20% on the 2024 figure, is positive news. “

“We believe the increase shows the effectiveness of Government measures to improve viability, such as Croí Cónaithe and the VAT reduction on the sale of new apartments. We expect these and other measures such as Help to Buy, Shared Equity and Cost Rental to deliver a greater volume of apartment units this year and next.”

According to the report the other main factors, which agents believe are influencing price movements include: changes in the state of the economy (17%); the availability of schemes designed to support potential house purchasers (14%); changes made by banks, for example to interest rates and the availability of credit (6%); and changes in the levels of immigration and emigration (5%).

Current Affordability Scenarios

With property prices nationally having increased by 172%* from their low point in early 2013, the SCSI included a range of scenarios for a couple earning a combined income of €112,000** and availing of the Help to Buy scheme towards their 10% deposit in its latest report.

The scenarios, demonstrate the affordability gap, if any, which exists between the total mortgage purchase limit available to a couple on average incomes looking to buy their first home and median new house purchase prices in four different locations. The scenarios included new three-bedroom semi-detached, three-bedroom terraced and two bedroom terraced homes.

Table 4 – Four scenarios for 3-bedroom semi-detached home. The purchase prices listed here are median purchase prices of 3 bed semi-detached homes based on new housing developments in the four counties analysed.

The analysis revealed that while all house types in some locations in Cork were affordable for this FTB couple, the three-bed semi-detached was unaffordable in the locations examined in Wicklow, Kildare and Meath. While the margin of unaffordability was comparatively low for this house type in Meath and Kildare at €2,000, in Wicklow the figure was €24,000.

As well as Cork, the median value of the two-bed terraced and three-bed terraced houses were affordable in Kildare and Meath. In Wicklow, the only house type the couple would be able to afford is the two-bed terrace, with a funding gap of €2,000 for the three-bed terrace home priced at €500k.

While Dublin is not included in the scenarios, based on house prices in the capital, it’s clear they are not affordable based on the income thresholds within the study.

Gerard O’Toole, who is a Westport based estate agent, says the scenarios show the scale of the challenge facing couples on good salaries, particularly those seeking to purchase 3-bedroom semidetached homes.

“House prices are rising faster than household incomes and the widening gap between market prices and purchasing capacity is very much borne out in these affordability scenarios.”

“According to the CSO, the median age of home buyers in Ireland has risen from about 35 in 2010 to around 40 in 2024, reflecting a significant trend towards older first-time and overall purchasers. This will have wider societal consequences including the fact that couples are not starting families until much later.”

“Despite recent improvements, Government scheme ceilings for the First Home Scheme and Help to Buy, which cap eligibility at €500,000, while helpful for some first-time buyers, are still misaligned with market values in high-demand areas. We would call on the Government to review those ceilings on a more regular basis to ensure their effectiveness.

“Of course, while our couple will find it very challenging to purchase a suitable home, others on lower income will struggle to purchase a home in the private market and will hope to qualify for either social or affordable housing.

“In the long term, the only way to moderate and gradually lower the affordability gap is by ramping up the supply of new homes while doing everything possible to drive down the delivery costs of new homes.”

Rental Sector

Tenancy restrictions on landlords selling properties with vacant possession are due to come into force next month for new tenancies from March 1st.

This policy shift has raised concerns among landlords, particularly smaller landlords many of whom are expected to exit the market due to perceived negative impacts on property values.

This is supported by data from the Residential Tenancies Board (RTB) data which shows a sharp increase in termination notices: 5,405 notices in Q3 2025, representing a 35% year-on-year rise and 14.3% growth from Q2 2025. Notably, 61% of these notices were issued because landlords intend to sell their properties.

Agents have also expressed concerns regarding the impact of the new measures and the extension of RPZs across the country.

In the survey, when asked about the impact of the extension of RPZs, 86% of agents said the measure would encourage more landlords to leave the market.

The three main reasons agents cite for landlords leaving the market are rent legislation being too complex and restrictive, net rental returns being too low, and landlords coming out of negative equity.

The SCSI is calling on the Government to pause the rental reforms.

Gerard O’Toole says this would allow time for proper consultation and engagement with landlords and other stakeholders.

“The Residential Tenancies Act 2004 has been amended numerous times, with all amendments up to the Residential Tenancies (Amendment) Act 2025 included in the current consolidated version. As well as causing problems for existing landlords the constant legislative changes have had a major impact on investment in the rental market.”

Smaller landlords make up almost a quarter of the market and the SCSI believes they require urgent support. In addition to postponing the new rental measures for a year it is calling on the Government to:

– Introduce an improved taxation environment on rental incomes for smaller landlords offering long-term leases;

– Review and increase to tax deductions / reliefs for maintenance and for these reliefs to also cover property improvements.

– Introduce a fairer system of classifying small and large landlords; and

– Simplify and streamline rental regulations.

Gerard O’Toole believes we need to create a more equitable, efficient and secure rental market for all stakeholders.

“We believe the State can ensure the long-term sustainability of the sector by fostering a more balanced regulatory environment, incentivising investment and addressing the needs of both tenants and landlords.”