- House rebuilding costs have increased by an average of 7% nationally over the last 12 months - Up 1% on last year

- Average rebuild costs increases vary from 3% and 5% in Cork and Dublin respectively to 9% in the North West

- SCSI says rate of increase is above that seen generally in the construction sector because rebuilding is more heavily impacted by labour costs and availability

- Chartered Surveyors urge consumers to check their homes are adequately insured using the SCSI’s updated House Rebuild Calculator

Tuesday Nov 4th 2025. The latest House Rebuilding Guide published by the Society of Chartered Surveyors Ireland (SCSI) shows that national average re-build costs, which include demolition and site clearance, have increased by an average of 7% over the past 12 months. This is up from the 6% rate of increase recorded last year but well down on the 12% increase recorded in 2023.

The SCSI’s House Rebuilding Guide, which has been published annually since 1989, helps homeowners to estimate the minimum rebuilding costs of their home for house insurance purposes.

While welcoming the stabilisation in the rate of increase, SCSI Vice President Tomás Kelly, a chartered quantity surveyor, said the level of increase in rebuild costs is above that seen

generally in the construction sector as it is more heavily impacted by labour costs and availability.

“The rates received in our survey of quantity surveying members, and in turn the rate of annual inflation determined, is a factor of the level of demand for contractors operating in this sector of the construction industry. Rebuilding work faces stiff competition from other construction work, including new residential construction, and if demand for that increases in an area, this reduces capacity and potentially increases the costs of such reinstatement work.”

“In terms of the main cost drivers, the introduction of two new levies, the Landfill Levy from 1 September 2024 and the Recovery Levy from 1 January 2025, are additional costs for demolition works in particular and construction works more generally.”

Regional Breakdown

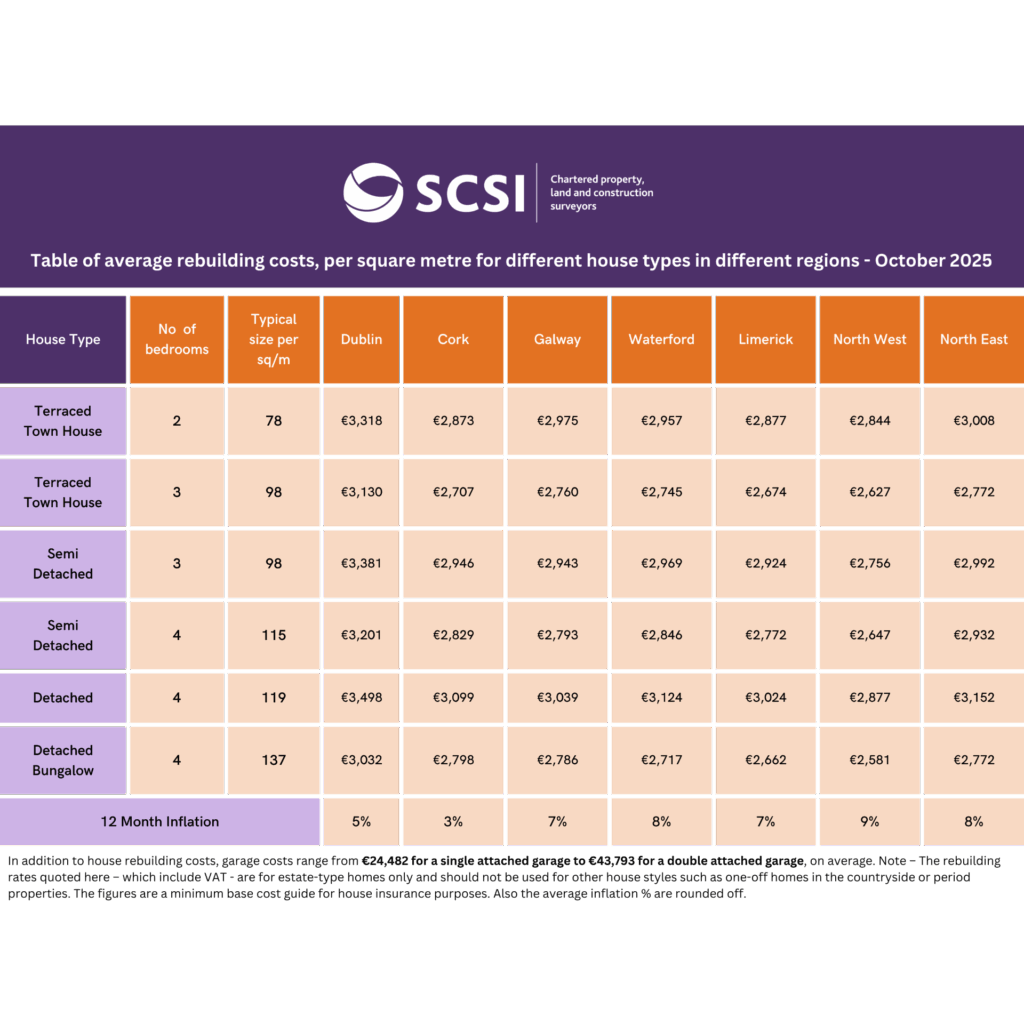

This year’s Guide shows – see Figure 1 – that increases in rebuild costs range from 3% and 5% in Cork and Dublin, respectively, to 9% in the North West. Although the North West recorded the highest percentage increase, the capital continues to have the highest rebuild costs while the North West has the lowest.

In other regional locations, Galway and Limerick both recorded rebuild cost increases of 7% and Waterford and the North East recorded increases of 8%. Mr Kelly says the main reason for regional variations is differences in demand for builders and tradespeople.

“The rate of inflation in the reinstatement costs can vary across regions for a variety of reasons but is principally driven by the level of activity in a region at a given time. The North East is experiencing significant development and its proximity to the Greater Dublin Area is a factor that sees a continuing narrowing of the cost differential in rates.”

“Again, this year, in the North West we are seeing the highest rate of increase. Whilst it remains the lowest rebuild cost region, the gap is reducing, and it is currently about 6% below the average of the regional locations.

Fig 1 SCSI House Rebuilding Costs for Insurance Purposes

2025 Table of average rebuilding costs, per square metre for different house types in different regions. In addition to house rebuilding costs, costs for garages range from €24,480 for a single attached garage to €43,790 for a double attached garage, on average. Note – The rebuilding rates quoted here are for estate type homes only and should not be used for other house styles such as one-off homes in the countryside or period properties. The figures are a minimum base cost guide for house insurance purposes.

Importance of being properly insured

While the rate of price increases has moderated in Dublin, it still has the highest rebuild costs, while the North-West has the lowest price but the highest rate of increase.

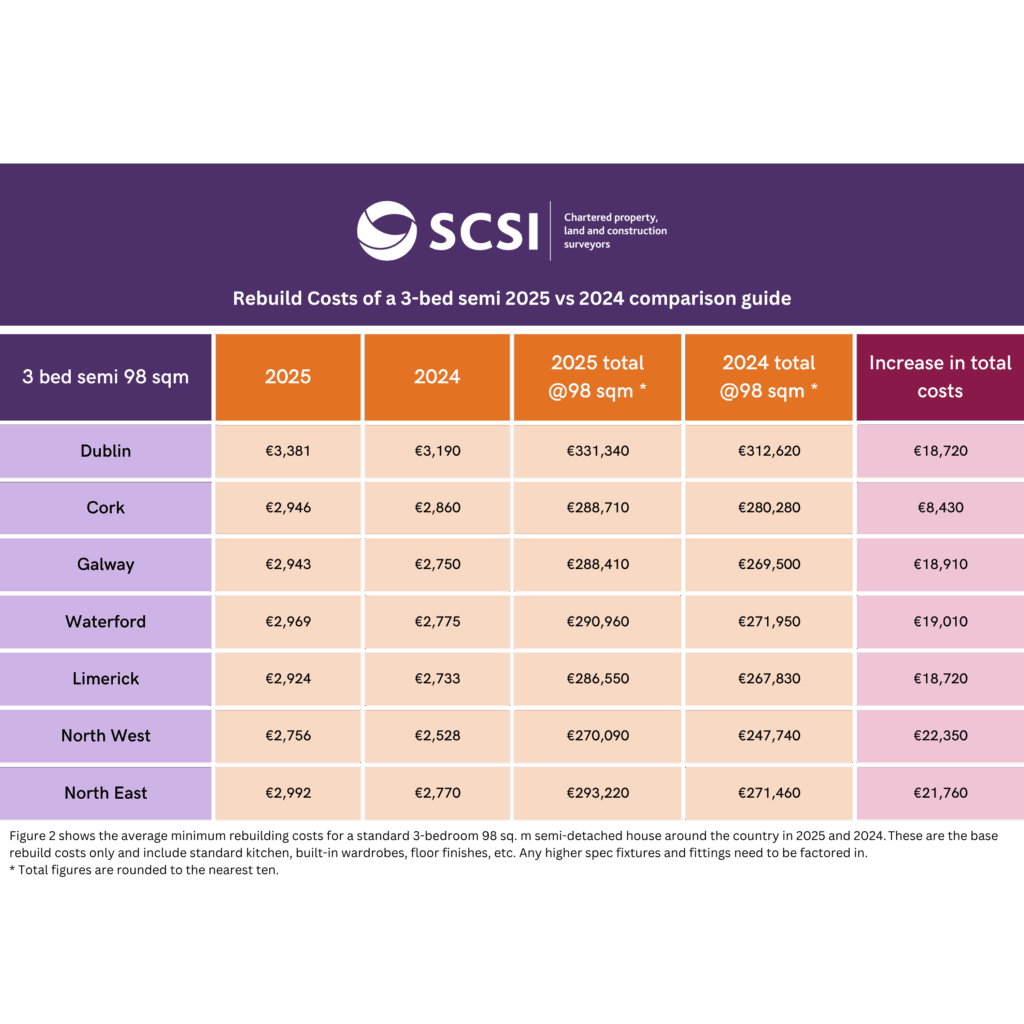

According to these figures, the minimum base cost of rebuilding a typical 3-bed semi, one of the most common house types in the country, is €331,340 in Dublin (98sqm x €3,381) while the minimum base cost of rebuilding a similar house in the North West, is €270,090 (98sqm x €2,756) – a difference of €61,250. The SCSI is urging homeowners to take the time to ascertain their minimum base cost reinstatement based on house type and location and apply any additional costs based on the specifics of their house.

“Homeowners need to ensure their house is adequately insured so that in the event of a total or partial loss situation ie a fire, they are covered under their insurance policy when reinstating or rebuilding. For example, rebuild costs for a 3-bed-semi have increased over the past 12 months from over €8,000 to over €22,000 depending on where you live.

“While these increases are significant it does not necessarily mean premiums will increase on a pro-rata basis and homeowners are advised to shop around when seeking insurance cover for their homes. It’s really important for homeowners to put aside ten minutes to use the SCSI House Rebuild Calculator, which is free – to get an estimate minimum reinstatement figure and ensure their home insurance is up to date.”

“If it’s not they need to contact their home insurer. Some insurers may auto adjust insurance policies annually, so homeowners need to satisfy themselves that any quotes they receive are aligned with current rebuild rates.” Mr Kelly said.

The SCSI points out that the rebuild figures are based on estate type houses and people with one-off homes or period properties are advised to contact their local chartered surveyor. A list of chartered quantity and building surveyors who carry out these assessments is also available on the SCSI website.

Rebuild costs of a 3-bed semi 2025 vs 2024 comparison guide

Fig 2 The average minimum rebuilding costs for a standard 3-bedroom 98sq.m semi-detached house around the country in 2025 and 2024. These are the base rebuild costs only and include standard kitchen, built in wardrobes, floor finishes etc. Any higher spec fixtures and fittings need to be factored in.

Dangers of under insurance

The President of the SCSI Gerard O’Toole said two issues which come up regularly regarding insurance are consumers mixing up valuations with rebuilding costs and homeowners not fully appreciating the dangers of under insurance.

“It is sometimes thought that the market value of a property, in other words the expected price which would be achieved if the property is sold on the open market, is the value for which the property should be insured. This is not the case as the relevant figure which needs to be calculated for insurance purposes is its reinstatement value i.e. the cost of replacing the property if it were to be destroyed.”

“Secondly many homeowners do not realise that if they are not adequately insured, they may be penalised under their policy by having to pay a certain proportion of the reinstatement costs out of their own pocket. For example, if the actual rebuilding cost of a property is €400,000 but the sum insured is for €300,000, that property is significantly underinsured. In the result of a genuine claim for damage covered under the policy of €100,000 being made, the insurance company payout will only be €75,000 as the policy holder was 25% underinsured.”

“In this situation, the insured party will be obliged to provide the balance of €25,000. This principle, known as the Condition of Average or average clause, reduces the payout proportionally to the level of underinsurance. It is something many homeowners may not be aware of, but the onus is solely on the policy holder to ensure a property is accurately insured.”

“Finally, it’s important that homeowners reassess their cover to take account of any changes such as home office extensions or garden offices and to include them in their house insurance.”

The SCSI’s House Rebuilding Calculator and the 2025 Guide to House Rebuilding Costs is available free at https://scsi.ie/calculator

For media queries please call the SCSI at (01) 6445500 and ask for Patrick King