New SCSI report shows rate of commercial construction inflation fell significantly in first six months of the year

- Commercial construction tender prices increased by 2.4% in the first half of 2023, down from 3.7% in previous six month

- Chartered Surveyors say national annual rate of construction price inflation is now running at 6.2% down from 11.5%

- Reduction in rate driven by stabilising supply chains and energy costs

- Shortages of skilled labour now the main pressure point driving inflation

Friday 25th August 2023: A new report by the Society of Chartered Surveyors Ireland (SCSI) shows that the rate of construction cost inflation has moderated significantly over the past year, falling by over a third in the first six months of 2023.

The latest Tender Price Index published by the SCSI shows the rate of commercial construction inflation increased by 2.4% in the first half of 2023, down from 3.7% in the second half of last year.

According to the SCSI’s Tender Price Index, which is the only independent assessment of commercial construction tender prices in Ireland, the annual median national rate of inflation from July 2022 to June 2023 was 6.2%, down from 11.5% in the preceding 12-month period (January 2022 to December 2022).

The SCSI Index recorded an annual median national rate of 14% between July 2021 and June 2022 which was the highest 12-monthly inflation rate recorded since the index began 25 years ago.

The report indicates some variation across the regions with a higher median rate of inflation of 3% recorded in Leinster (excluding Dublin) and Munster while the median rate in Dublin and Connacht/Ulster is 2%.

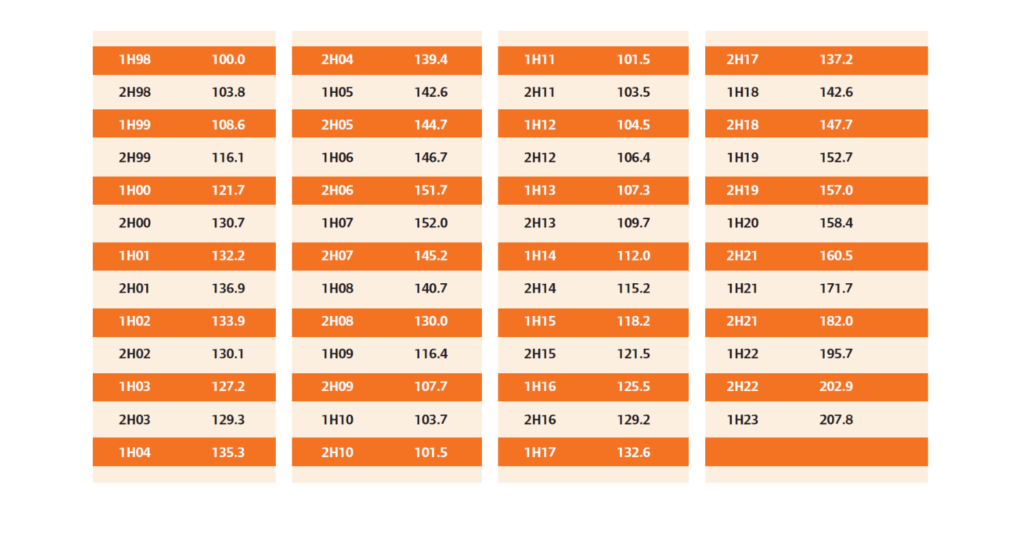

Fig 1. Construction Tender Prices H1 1998 – H2 2023 Research for the latest edition of this sentiment survey, which is based on responses from Chartered Quantity Surveyors from all round the country, working on commercial projects, was conducted in July 2023.

Donal Hennessy, Chair of the Quantity Surveying Professional Group in the SCSI said that while inflation is still an issue for the construction sector, the more subdued rate of increase compared to 12 – 18 months ago is a welcome development.

“Material price inflation is still an issue, but it is becoming less of a driver as supply chains and the cost of energy in manufacturing materials have stabilised compared to the immediate post Covid period. Right now, the availability of labour is becoming the dominant concern for the sector with rising labour costs, driven by skilled labour shortages and wage demands applying significant pressure to tender price inflation.”

“The labour shortage impact is particularly acute in the mechanical and electrical services area where resources are in high demand in the pharma and commercial sectors. While we welcome the ‘Careers in Construction Action Plan’ launched earlier this week by the Government, it’s clear this is an area which needs to be prioritised and which will require continual focus for the foreseeable future.”

Chartered Quantity Surveyor Kevin Brady said while the prices of most materials were levelling off, concrete remained an exception.

“Although prices for certain materials and construction inputs such as steel reinforcement, insulation and fuel are settling down, concrete prices are continuing to rise according to respondents of our survey. This is a real concern for the sector particularly given the Government plans to introduce a ‘concrete levy’ in Q3.”

“Looking at the national picture, costs continue to be driven by high construction demand due to economic growth and population expansion. As a result there is an ongoing need for new infrastructure and construction projects, driving up construction activity and tender prices. However, barring any major economic shocks, we expect to see a continuation of low single digit growth figures in the medium term. And while the overall trend is positive for the sector as far as a levelling off of this Index is concerned, capacity pressures as well as the high interest rate environment will continue to put pressure on the financing of projects, leading to significant uncertainty in the market.”

Ends.

For more information

Contact Kieran Garry

GPR Communications

087/2368366

Note to Editor

Methodology and Use of Data Notes

The Index is the only independent assessment of construction tender prices in Ireland. It is based on the responses of 194 Chartered Quantity Surveying members of the SCSI who undertook the survey in July 2023. The Tender Price Index (TPI) H2 2022 is based on sentiment returns only. The TPI is for non-residential projects during the period in question. It is based predominately on new build projects with values in excess of € 0.5m and covers all regions of Ireland. The Index relates to median price increases across differing project types and locations. The SCSI uses median values rather than averages, as this gives a more accurate reflection of the responses it receives. It should be regarded as a guide only when looking at any specific project, as the pricing of individual projects will vary depending on such factors as their complexity, location, timescale, etc. It is important that the TPI report is used appropriately and not for all construction projects, including those in the residential sector and those below €0.5 million. The Tender Price Index H2 2022 provides median reported figures across all project tiers. Breakdowns by tier may vary. Project specific advice should be sought from a Chartered Quantity Surveyor before deciding an appropriate TPI provision for individual construction projects.