- Commercial construction tender prices increased by 1.5% in the first half of 2025

- National rate of commercial construction inflation is now running at 3% per annum

- SCSI urges Government to avail of stable rates and to accelerate investment in key economic infrastructure under the National Development Plan

Thursday 21st August 2025: A new report by the Society of Chartered Surveyors Ireland (SCSI) shows that while commercial construction costs are continuing to rise, the rate of increase has remained relatively stable over the past two years.

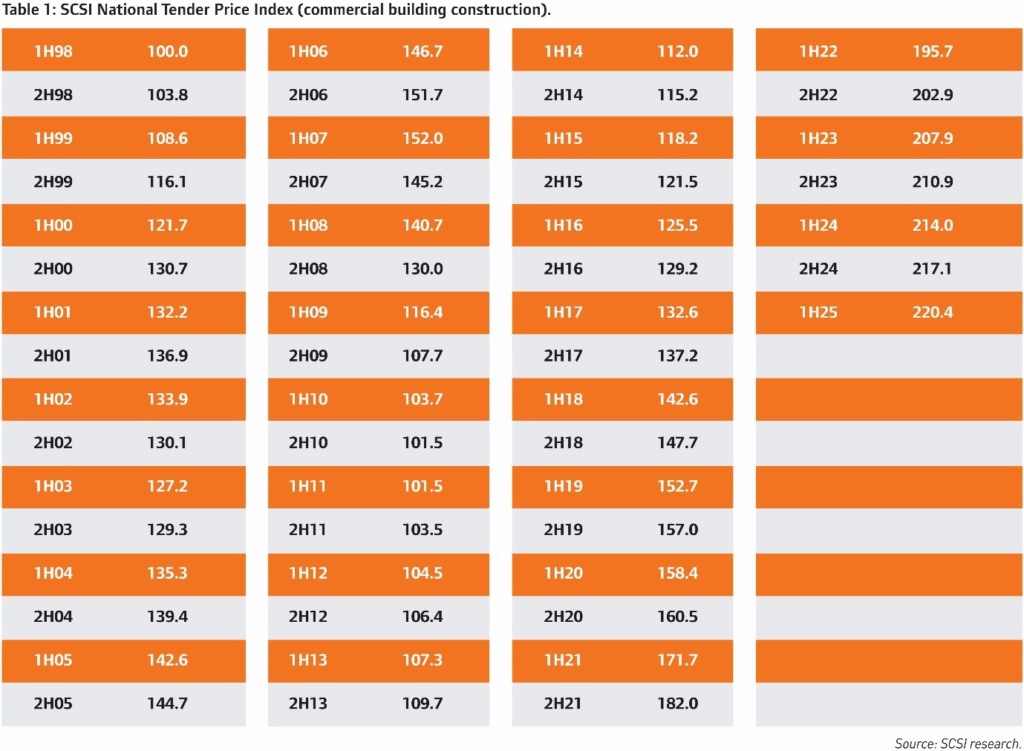

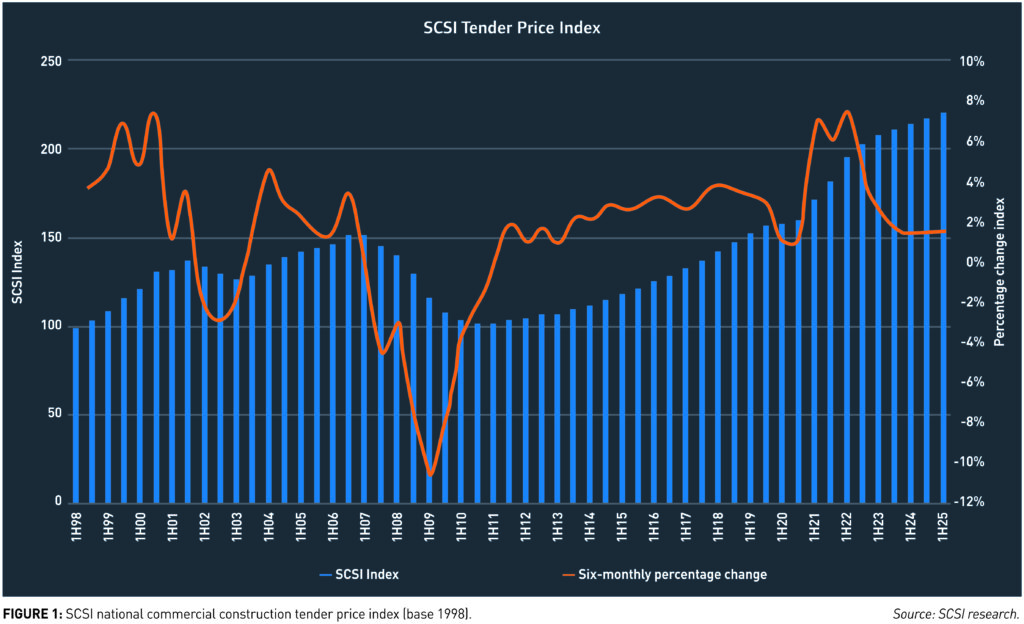

The latest Tender Price Index (TPI) published by the SCSI shows the median rate of commercial construction inflation increased nationally by 1.5% in the first half of 2025, the same rate as the three preceding six-month periods.

According to the SCSI’s Tender Price Index, (TPI) which is the only independent assessment of commercial construction tender prices in Ireland, the annual median national rate of inflation for the past 12 months was 3%.

The report indicates some variation across the regions over the last six months with the highest median rate of inflation of 2% recorded in Munster and Connacht / Ulster. In Dublin the figure was 1% while Leinster (Excl Dublin) had the lowest rate of increase at 0.5%.

Fig 1. Construction Tender Prices 1998 – 2025 Research for the latest edition of this sentiment survey, which is based on responses from Chartered Quantity Surveyors from all around the country, working on commercial projects, was conducted in July and August 2025.

Analysis

The Vice President of the SCSI, Tomás Kelly described the continuing moderation in the rate of increase over the past two years as a welcome development.

“The reduction in the rate of increase which we’ve seen over the last couple of years is due in the main to reduced supply chain disruption and price volatility for construction materials. The relative stability we’ve seen over the last couple of years is in marked contrast to the 2021 / 2022 period when tender price inflation increased significantly. However, while overall inflationary pressures have moderated, ongoing geopolitical uncertainty, over conflicts and the potential introduction of reciprocal tariffs between the US and the European Union have the capacity to cause fresh supply chain disruption.”

“While we believe tender prices will continue to edge higher in the second half of 2025, given global uncertainty it is very difficult to predict if the moderate rates we have seen over the past two / two and a half years will continue. While it’s true that fears of a tariff war may be receding at the moment, that may change.”

Impact of Labour Shortages

Among other challenges identified were access to labour, with surveyors highlighting continuing labour shortages and constraints, as well as the inflation of labour prices. While overall inflationary pressures have moderated, feedback from quantity surveyors indicates that labour-related costs continue to influence tender pricing across certain projects.

National Development Plan

Mr Kelly reiterated the SCSI’s call on the Government to invest in key economic infrastructure while price inflation remains at more sustainable levels.

“We welcome the recently published update of the National Development Plan as a long-term strategic infrastructure plan of €275 billion up to 2035. The current period of tender price stability provides a great opportunity for Government to push forward with the much-needed infrastructure investment across a range of sectors.

“For example, with regard to utilities urgent investment is required in the water supply network, in wastewater treatment and in the electricity grid. Critical investment is also required across the transportation, residential and healthcare sectors.”

“We would also urge the Government to publish the sectoral investment plans in order to provide specific details of the projects and pipeline up to 2030.”

For media queries please call the SCSI at (01) 6445500 and ask for Patrick King.

Note to Editor

Methodology and Use of Data Notes

The statistics extracted from our member survey were utilised in outlining the findings of this report, which is intended to give a general overview of median commercial tender price trends within Ireland’s construction sector. The Index is the only independent assessment of construction tender prices in Ireland. It is compiled by Chartered Quantity Surveyor members of the SCSI.

The TPI 1H2025 is based on sentiment returns only. The TPI is for commercial projects during the period in question. It is based predominately on new-build projects with values in excess of €1m and covers all regions of Ireland. The Index relates to median* price increases across differing project types and locations. It should be regarded as a guide only when looking at any specific project, as the pricing of individual projects will vary depending on such factors as their complexity, location and timescales. It is important that the TPI report is used appropriately and not for all construction projects, including those in the residential sector and those below €1m.

The TPI 1H2025 provides median reported figures across all project tiers; breakdowns by tier may vary. Project-specific advice should be sought from a Chartered Quantity Surveyor before deciding an appropriate TPI provision for individual construction projects. The data outlined within this report was provided by SCSI Chartered Quantity Surveyors with direct expertise and knowledge on the market conditions in the construction sectors across the country. The statistics extracted from our member survey were utilised in outlining the findings of this report, which is intended to give a general overview of median commercial tender price trends within Ireland’s construction sector.

*From 1H 2021 onwards, the median value is used as the statistical methodology.