The main findings:

- National average farmland sales prices forecast to rise by 6% in 2025

- Average price of non-residential agricultural land in 2024 was €9,907 per acre, an increase of 7% on 2023

- The most expensive land is in Waterford where good quality land on 50 to 100 acres holdings is fetching an average of €23,500 per acre

- The least expensive land is in Mayo where poor-quality land is selling for an average of €3,075 per acre on holdings over 100 acres

- SCSI agents expect average national land rental prices to increase by 7% this year

- Last year average land rental prices increased by 7% in Leinster, 3% in Munster and 13% in Connacht / Ulster

- Agents say lack of supply and strong demand for land, particularly from dairy farmers will continue to drive prices

- “But introduction of US import tariffs could temper rise in land prices”

- Teagasc says strong output prices should continue this year for most farming sectors but cautions about uncertainty in dairy markets over tariffs

- SCSI says Government should consider introduction of additional incentives to bring more land onto the market

Tuesday 29th April 2025.

SCSI auctioneers and valuers say the outlook for the agricultural land market remains strong for 2025 and are forecasting that the price of agricultural land nationally will increase by 6% on average this year.

In a major new report with Teagasc, auctioneer, and valuer members of the Society of Chartered Surveyors Ireland (SCSI), operating in the agricultural sales and rental market say average rental prices in 2025 are expected to increase by 7%.

In Munster, average rental prices are expected to rise by 8% while in Leinster and Connacht / Ulster an increase of 7% is forecast.

SCSI auctioneers and valuers say they expect land values to rise again primarily due to better milk prices, strong competition among farmers and investors and recent changes to Ireland’s Nitrates Action Programme. Due to the latter, some farmers require more land to meet lower stocking rate thresholds, which further increases the demand, especially among dairy farmers in Ireland.

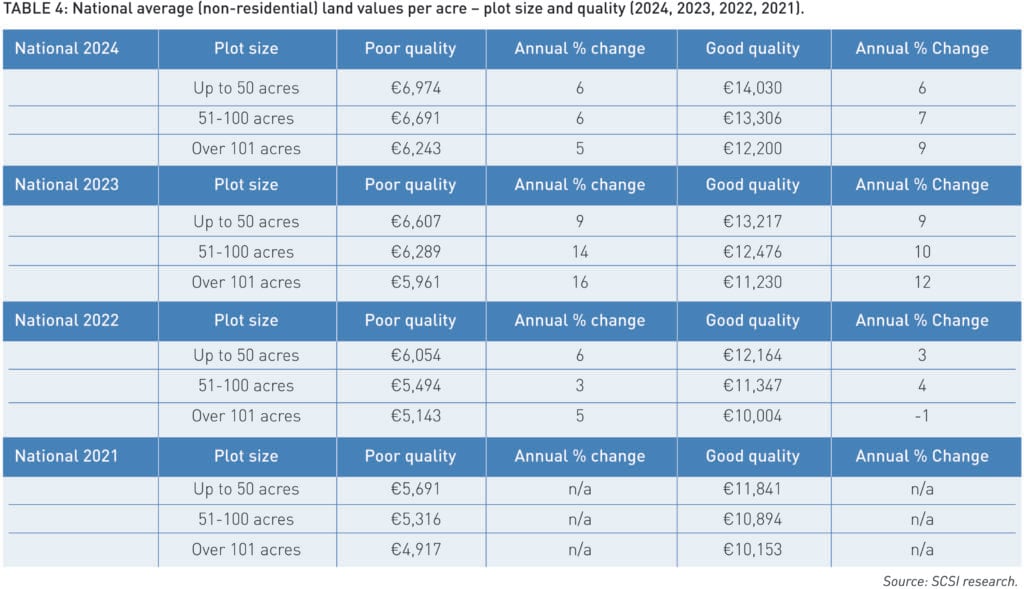

The average price of non-residential agricultural land in 2024 was €9,900 per acre, which is an increase of 7%, up from €9,297 in 2023.

According to the Society of Chartered Surveyors Ireland / Teagasc Agricultural Land Market Review and Outlook Report 2025, the Central Statistics Office data shows that the share of agricultural land, which transacts for sale annually is only around 0.5% of agricultural area and this, combined with strong demand for agricultural land is driving the increase in land prices.

Land Rental Prices

In Munster, there was a mixed trend in year-on-year land rental prices. Average rental prices for grazing and meadowing /silage declined from between 3% and 5% and now stand between €284 per acre and €294 per acre. Conversely, land rental prices for other crops such as maize and beans rose by 8% on average indicating a steady demand for animal feed crop growing.

By contrast Connacht / Ulster saw the highest provincial rental price inflation across grazing/silage and grazing-only lands, 14% and 13% respectively with the average price of the former reaching €208 per acre and the latter reaching €177 per acre.

In Leinster (excluding Dublin), land rental prices for grazing/meadowing/silage, grazing only and potato growing all increased by 9% on average to €295, €271 and €467 per acre respectively. The rental price of land for cereal crops increased by 8% to €317 per acre while rent for land rental prices for other crops such as maize and beans, increased by just 2% to €351 per acre.

The survey of 169 auctioneers and valuers from all over the country, took place in February and March 2025. It found the volume of farmland going to market increased marginally during 2024 with probate sales continuing to provide the main source of farmland sales.

National and Regional Land Sales Prices

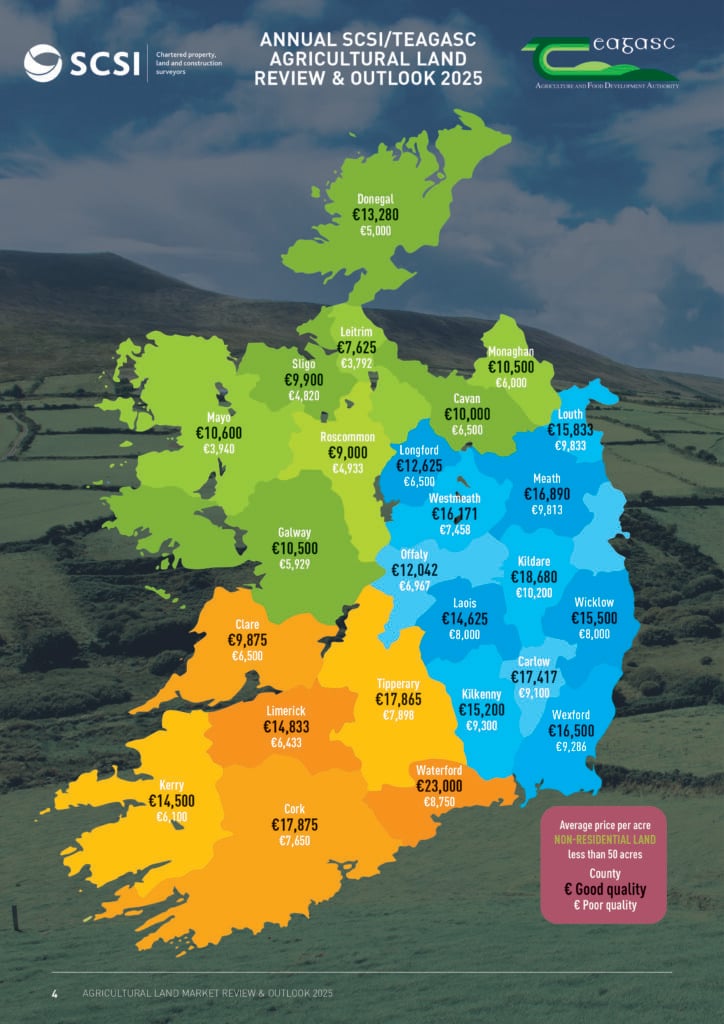

This year’s annual survey, the twelfth in the series, provides a county-by-county breakdown of the prices of good and poor-quality land. (See attached County by County Map of Ireland and Provincial Tables for detailed breakdown of figures across land type and holding size)

The survey found that in 2024 Waterford has the most expensive land in the country with good quality land on holdings between 50 and 100 acres fetching an average sales price of €23,500 per acre.

Mayo has the lowest land sales prices in the country at €3,075 for an acre of poor-quality land on holdings over 100 acres.

After Waterford, which also had the most expensive land on holdings under 50 acres at €23,000 per acre, comes Kildare at €18,680, with Cork in third place at €17,875, just marginally ahead of Tipperary on €17,865. In Carlow, the average price of good quality land on holdings of less than 50 acres is €17,417 per acre, while rounding off the top six places is Meath on €16,890.

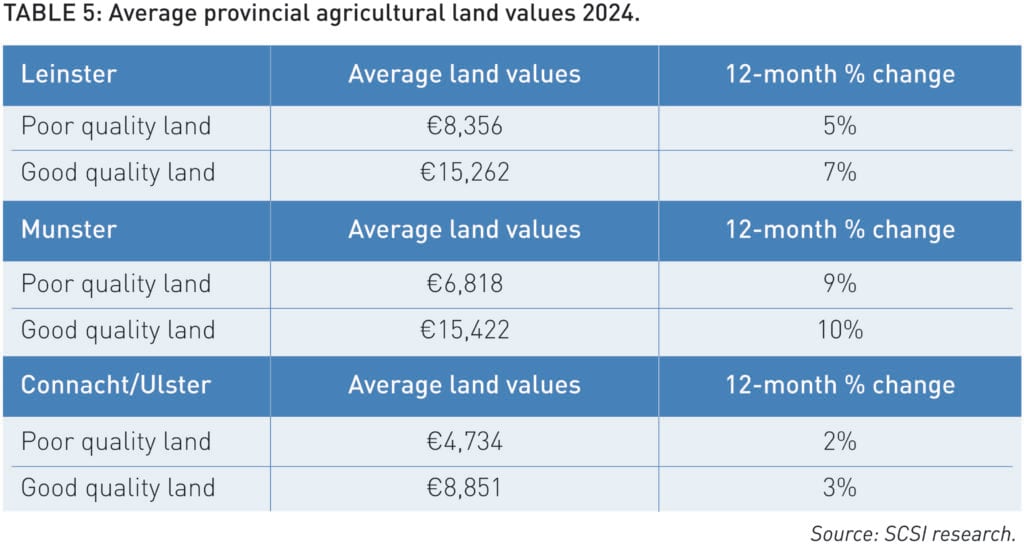

In Munster, sales prices for good quality land on holdings under 50 acres range from €23,000 in Waterford to €9,875 in Clare. Prices for poor quality land ranged from an average of €8,750 in Waterford to €6,100 in Kerry.

In Leinster, sales prices for good land in 2024 on holdings of less than 50 acres range from Kildare’s high of €18,680 – up from €16,400 the previous year – to €12,042 in Offaly, while the prices for poor-quality land range from a high of €10,200 in Kildare to €6,500 in Longford.

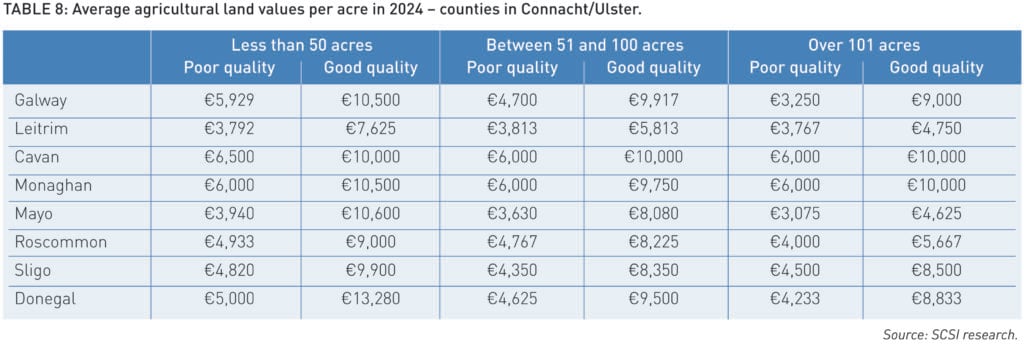

In Connacht/Ulster, sales prices for good land on holdings under 50 acres ranged from an average of €13,280 per acre in Donegal – down slightly on last year – to €7,625 in Leitrim. Prices for poor quality land ranged from an average of €6,500 in Cavan to €3,792 per acre in Leitrim, the lowest price in the country for holdings under 50 acres.

Land Market Outlook 2025

Dr. Frank Harrington, Chair of the SCSI’s Rural Agency Committee and Discipline Lead of Real Estate and Valuations at TU Dublin, says land prices are being driven by a continued low

supply of land to the market and demand across major sectors for agricultural outputs including a thriving dairy sector.

“Dairy farms are projected to have a robust 2025 and will continue to significantly influence the demand for both owned and leased land. Over three quarter of respondents to our survey (77%) ranked dairy farmers as the main buyer type of agricultural land. In addition, 62% of respondents expect an increase in demand from dairy farmers in 2025, with just 2% of respondents expecting this demand from dairy farmers to decrease.”

“But there are also several other factors which are supporting the positive outlook. After a poor start, last year’s weather improved, and as a result crop yields performed better than expected. We have also seen a marked reduction in interest rates, which of course means lower finance costs.”

“That said uncertainty in the global economy, along with recently imposed U.S. tariffs on EU agricultural products are casting a long shadow. While it’s impossible to predict the outcome and potential impact, it’s clear these factors could introduce volatility into the land market and may temper some of the upward price momentum.”

Dr Harrington said one noticeable trend survey respondents picked up on is a significant landowner shift towards long-term leasing over short-term rentals.

“As the market continues to evolve, we believe long-term leasing will remain the preferred model, supported by government policies that encourage security of tenure and investment in land productivity. As a result, nearly 84% of survey respondents noted that farmers would typically pay more per acre for similar quality land on a long-term lease compared to conacre.”

Agricultural Outlook 2025

Teagasc economist, Dr. Jason Loughrey, says that the strong improvement in output prices for livestock and milk which emerged last year is continuing into this year.

“Last year, we saw strong price growth for milk – up 16% – and lamb – up 18%. On average, dairy farms and sheep farms recovered from a difficult 2023. Cattle prices were also up 4.5% compared to 2023 while the picture for pigs and cereals was more mixed. At the same time, overall input prices decreased with lower prices for significant inputs such as feed and fertiliser in particular.”

“It is estimated that the average net margin per litre of milk produced increased by 84% to 13.3 cent per litre last year. Prices were higher in the first quarter of 2025 compared to the first quarter of 2024. This year, beef prices have reached record levels and were approximately 40% above the average for the first quarter of last year. So far this year lamb prices are up 19%.”

“However, the introduction of new tariffs on exports to the US is adding uncertainty for both the short and medium term. Exports of Irish butter to the US have grown rapidly in recent years and this market may become less lucrative given the imposition of 10% tariffs with the possibility that additional tariffs may be imposed.”

Dr Loughrey noted that aside from the impact of tariffs themselves, the prospect of a trade war is also affecting exchange rates and global economic growth prospects.

“Having been close to parity with the euro in January 2025, the US dollar has since weakened in value. This has negative implications for the euro value of Irish agri-food exports traded in dollars and positive implications for the cost in euro terms of imports of key agricultural inputs such as feed, fertiliser and energy, which are also traded in dollars.”

Generational Renewal

This year’s report devotes a special section to the complex area of farm succession and generational renewal. It notes that farmers comprise an ageing workforce – the average age is 59 years and only 4.3% are under 35 years.

Responses from the SCSI survey of auctioneers and valuers indicated the main reasons for such low land volumes coming to the market for sale relate to cultural, taxation and succession planning issues.

Dr. Frank Harrington said the overwhelming response of survey respondents was that the Government should review the tax treatment of agricultural land to entice more land to the market to support the younger generations of farmers.

“Land mobility continues to remain a significant challenge. Our report highlights that policy changes in taxation and financial incentives may be necessary to encourage more land onto the market for sale. More land on the market would assist younger farmers enter the market which could also help improve profitability in farming with a scaling up of food production”.

“The responses to the survey highlight that in the context of an ageing farming demographic, there is a greater likelihood that their land will be made available for long-term leasing rather than being made available on the sales market.”

Dr Jason Loughrey said;

“Research highlights the need for policies that allow for gradual transitions rather than ‘abrupt’ retirement, especially given the number of farmers who indicate that they never plan to retire. While it appears that young farmers have difficulty in competing in land rental markets, insights from the Teagasc National Farm Survey suggest that a large volume of additional land may become available to land rental markets in the medium-term.

“This may support the prospects for younger farmers in some parts of Ireland. However, the availability of medium-sized and large plots of land will remain important for younger farmers in regions where dairy and tillage farming are most prevalent. We need to put the structures in place now to facilitate this type of land market activity”

The full report is available at https://scsi.ie/land/

For media queries please call the SCSI at (01) 6445500 and ask for Patrick King.

Note to Editor

This is the twelfth in a series of annual reports on the state of the land market produced by the Society of Chartered Surveyors Ireland (SCSI) and the Agricultural Economic and Farm Surveys Department of Teagasc. The report brings together the respective expertise of both organisations to increase the range and quality of the data that is available on the agricultural land market in Ireland. The land price and land market activity data are based on survey responses from 169 SCSI members from around the country who completed the survey in February and March 2025. Respondents are chartered surveyors operating in the auctioning, private treaty, tendering and rental of land including those that provide specialist valuation services to clients.