Society of Chartered Surveyors Ireland report “The Real Costs of New Apartment Delivery 2025” – While the costs of apartment delivery have risen over the last five years, the increases have not been uniform. State interventions are playing a critical role in closing the financial viability gap; affordability remains the key challenge.

Main Findings:

- Total development costs of delivering 2-bed lower range urban medium rise apartments have increased by between 4% and 6% since 2021.

- Total development costs for these lower range apartments extends from €523K to €537K

- However, the cost of delivering lower range suburban medium rise apartments has risen by 32% – or from €411K to €541K

- Surveyors say the increase is due to a change in the type of apartment being developed as costs converge around a more standardised design

- Detailed case study shows state interventions are helping to bridge the financial viability gap

- Analysis shows that without Government initiatives, just 2 out of 6 apartment types are viable, with them 5 out of 6 are viable

- However, affordability remains a huge challenge – with Government supports, first-time buyers or fresh start applicants would require a combined salary ranging between €84K to €129K to purchase an apartment

- To increase supply and reduce costs, surveyors are calling for continuation of levy waiver extensions and Úisce Éireann waivers, a remediation programme for brownfield sites and the establishment of a National Housing Bond – an ‘SSIA for housing’

Tuesday 9th December 2025

A major new report has found that the total development costs of delivering urban medium rise apartments in Dublin, Cork, Limerick and Galway have increased by between 4% and 6% over the past five years.

‘The Real Costs of New Apartment Delivery 2025’, which is published by the Society of Chartered Surveyors Ireland, found that the total development costs of an urban two-bedroom medium rise apartment (8-15 stories) increased by 4% from €514K to €537K.

Meanwhile the total cost of delivering an urban two-bed medium rise apartment (5-8 stories) increased by 6% from €493K to €523K.

However, the report found that over the same period the cost of delivering a suburban medium rise apartments increased by 32%. The cost of delivering this apartment type has risen from €411,000 to €541,000, due in the main to a change in the type of apartment building being developed.

The latest report is based on data covering over 10,700 apartments across three different categories in four different cities. A lower and higher range of costs are provided for each category in the report. The total development costs for the upper range goes from €663K to €680K per two-bed apartment.

Paul Mitchell, a chartered quantity surveyor and one of the co-authors of the report said the findings show that a more standardised apartment typology is starting to emerge.

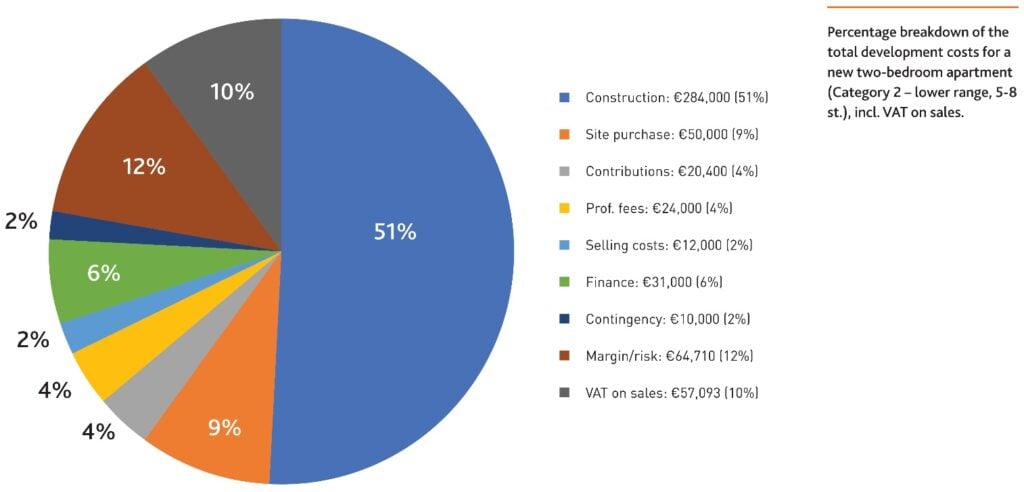

“Apartment delivery costs comprise five main buckets as it were. These are construction costs, or hard costs, which make up to 50% of the overall cost, site costs, soft costs (professional fees, finance etc), VAT and margin/risk.”

“Construction costs for lower range urban medium rise (5-8 stories) and (8-15 stories) have increased by 22% and 19% respectively, beating the general construction inflation rate of circa 26%. The other main contributors we are seeing to the easing of delivery costs for these apartment types are the reduction in VAT from 13.5% to 9% and a notable decline in average site values.”

“When averaged, site purchase costs for these apartment types have fallen from up to €80K per unit in 2021 to a maximum of €65K per unit in 2025. This is very welcome. On the other hand, hard costs for the lower range of suburban apartments have increased by 49% since 2021 while this apartment type also saw the highest increase in soft costs at 26%.”

Paul Mitchell says the disparity in costs reflects a major shift which is taking place in the evolution of apartment design and delivery.

“In the previous 2021 report we didn’t have cost rental apartments, now cost rental makes up half of the apartments in this data set. We are seeing a shift away from suburban apartments to duplexes to achieve required density, while the focus with apartment construction is on building more efficient larger schemes. This is a really positive development in the industry.”

“While the cost of what was the cheapest apartment to build has increased by the most, the cost of the more expensive apartments has eased considerably. In fact, our analysis shows that while the difference between the cheapest and most expensive apartment in 2021 was 58%, the difference or spread in our latest report is just 21%. In practical terms this means the variation in cost per sqm has narrowed across all apartment types to between €2,600 to €3,150 per/sqm where previously it was €1,850 to €2,850.”

Viability and impact of Government subventions

The report examined the financial viability and affordability of a two-bedroom unit for a Build to Sell unit. Before any interventions from government, just two apartment categories were viable – the lower range options for both urban medium rise apartments.

However, after government interventions such as the reduction of VAT and Croí Cónaithe, five of the six types became financially viable. The one which wasn’t was the higher range suburban medium rise apartment.

Mr Mitchell said this shows that current government policies are helping to bridge the financial viability gap in higher income areas, but other outer suburban and regional areas still require a lot of assistance The SCSI is calling for Croí Cónaithe to be extended beyond the five National Planning Framework cities to other regions.

Affordability

Despite the improvements in viability the report highlights the fundamental structural affordability gap which buyers, particularly first-time buyers face. Sales prices for the two-bedroom apartment range from €480K for a suburban medium rise to €650K (including VAT) for an urban medium rise (8-15 stories).

To afford these apartments before any government support scheme, based on a 4-x loan-to-income ratio, a first-time buyer couple would require a combined salary ranging between €108K to €146K.

Because the Help to Buy Scheme (€30,000) and the First Home Scheme (up to 30% equity or 20% if HTB is used) are unavailable for apartments above the €500,000 sales price threshold, their impact is limited with the price of most of the 2-bedroom apartments used in this study having a sales price in excess of that figure.

They do have a positive impact on lower range suburban apartments which are on sale for €480K. Here due to the government supports the salary required drops from €108K to €84K.

Paul Mitchell says the affordability gap prevents most average income earners from accessing apartment supply without significant government supports. “Based on CSO figures only the top 20% of earners in Ireland can afford to rent an apartment, only the top 40% can afford to buy an average apartment, while the cost rental scheme, which has defined parameters, is targeted at couples earning less than €59-66k net.”

“We need supply, but we can’t build it on our own. The recent reform of the RPZs will help but it will still take time for international investors to return and as the case study below shows, this is an area we need to prioritise.”

Case Study

A 48-unit apartment block from a larger development in south County Dublin was selected for a detailed case study analysis. The block comprises six storeys, with an average of eight units per floor arranged around a single stair core.

The case study evaluates both viability and affordability across three tenure types: Build to Sell, Private Rented, and Cost Rental. It also considers the impact of current Government initiatives aimed at improving apartment viability and affordability, including the proposed new apartment design guidelines.

Build to Sell: Before the implementation of design changes the apartment block showed a loss of €24k/unit. This was reduced to a €12k/unit loss following the redesign. The €18k VAT reduction brought the margin to almost €6k/unit profit and then €52k Croí Cónaithe intervention brought the scheme to a €58k margin or 13% gross margin on costs. This is close to the typical 15% margin/risk hurdle typically required to secure funding, depending on the risk profile of the project from a funding perspective.

Private Rented Sector: While the pre-design block showed a €43k/unit loss, the redesign and VAT reduction brought the loss to €10K. Unlike other tenures, the PRS does not have other interventions beyond the VAT and revised design guidelines.

Cost Rental: The base case design showed a€403/month loss was calculated. This was reduced to €350/month loss following the redesigned scheme. The VAT reduction accounted for €12/month in savings, while the remaining deficit was addressed by the STAR subvention closing the €333/month gap and bringing the average rent per unit to €1,653 / month.

Recommendations

The SCSI believes the findings, along with the case study, demonstrate that Government interventions are helping to bridge the financial viability gap which exists, but that clearly huge challenges remain with regard to affordability.

Paul Mitchell says while the measures introduced are having a positive impact, additional supports will be required in the Private Rented Sector if the government is to attain its goal of 300,000 new residential units by 2030.

“We believe the government needs to build on what they have achieved to date and extend levies and Uisce Éireann waivers, including S.49 levies. Foreign investment is vital for the private rented sector, and we believe the government needs to investigate a time limited commercial package to kick-start this sector.”

“The government should also introduce a ‘Brownfield Remediation Relief’ scheme equivalent to the UK Land Remediation Relief. This would enable contaminated sites in urban areas to be reclaimed and brought into residential use. Finally, the SCSI is reiterating its call for the establishment of a National Housing Bond – a type of SSIA for housing – which could be used to seed SME housebuilder schemes and ensure they have access to low-cost financing.”

For media queries please call the SCSI at (01) 6445500 and ask for Patrick King